A Critical Analysis of the Contino Case

Contino v. Leonelli-Contino

A Critical Analysis of the Ontario Court of Appeal interpretation of Section 9 of the Child Support Guidelines

By Gene C. Colman*

The author maintains that when addressing section 9 of the Child Support Guidelines, the Ontario Court of Appeal quite correctly analyzed but only part of the problem. The author criticizes the Court on two grounds: 1) When implementing its articulated general principles, the Court seemed to treat the parents on a basis that might be explained by gender. As joint custodial parents – each with 50 per cent of the child’s time – both former spouses should have been treated in the same manner. 2) The Court seemed to be unaware that the underlying design of the Child Support Guidelines incorrectly assumes that an access parent incurs no cost at all connected with the exercise of access. Therefore, the Court’s consideration of the incremental costs of moving from under 40 per cent to 50 per cent of the child’s time, had to be inherently flawed.

The Contino case was subsequently adjudicated in the Supreme Court of Canada. The SCC changed the law and cited this article favourably in its decision.

INTRODUCTION

How do we fairly and equitably apportion responsibility for child support where the parents share the child’s residential time on an approximately equal basis? The Ontario Court of Appeal recently had an opportunity to bring some clarity to this admittedly difficult practical problem.

Section 9 of the Federal Child Support Guidelines[1] (referred to below simply as “the Guidelines”) addresses the joint custody scenario:

9. Where a spouse exercises a right of access to, or has physical custody of, a child for not less than 40 per cent of the time over the course of a year, the amount of the child support must be determined by taking into account

(a) the amounts set out in the applicable tables for each of the spouses;

(b) the increased costs of shared custody arrangements; and

(c) the conditions, means, needs and other circumstances of each spouse and of any child for whom support is sought.

Section 9 has received somewhat mixed treatment in our courts.[2] In his weekly Westlawecarswell on-line newsletter, Prof. James G. McLeod offered these sharp words, in his customary tongue-in-cheek manner: “I really want to say something nice about the Court and this case. Honest. But it is difficult.”[3] In this article, I will indeed say “something nice” about the decision of the Court of Appeal. I will also demonstrate where I believe the court’s analysis was less than fair and in fact, was somewhat discriminatory.

FACTS

In Contino v. Leonelli-Contino,[4] the 1992 separation agreement provided for joint legal custody of the parties’ one child. It would appear that the child resided primarily with the mother subject to the father’s liberal access. In 1998, child support was varied on consent from $500.00 to $563 monthly based on the father’s income of $68,712. Additionally, orthodontic expenses were to be shared equally although mother’s income was less than father’s: $53,292. There was to be an annual adjustment in accordance with the father’s income but this never happened even though father’s 1999 income was $83,527.

In March 2001, father sought a reduction in support based upon his claim that the child was now with him 50% of the time. Mother argued at the motion before Justice S. Rogers that this state of affairs came about as a result of the mother’s taking a course on one night of the week. The father refused to switch nights with her but offered to care for the child on the course night. Although the course had been temporary, the extra night arrangement continued on a permanent basis. In any event, the bottom line appears to have been that the father advanced from less than 40% of the residential time to 50% of the residential time. Thus, the facts now came within section 9 of the Guidelines.

The father’s material with respect to his custody costs was sparse. One would have thought that, given the factors set out in paragraphs 9(b) and (c), counsel would have been more careful to fully delineate “the increased costs” as well as the wide variety of factors that should be relevant under paragraph (c).

THE MOTION

The motions judge concentrated solely on “math”, as she phrased it. The father’s argument was that the Court should consider the difference between the two table amounts (it was $128) and then adjust for the added costs of joint custody. This brought him to a final figure of $96.00. The motions judge ordered $100.

THE DIVISIONAL COURT

The Divisional Court relied on Francis v. Baker[5] in finding that, under the Guidelines generally, the court must presumptively find in favour of the table amount. The Court allowed the appeal, restored the 1998 order and increased support to $688 monthly retroactive to September 2000 on account of the father’s increased income. (The table amount would be $663.00.)

COURT OF APPEAL RESULT

The father appealed to the Ontario Court of Appeal where the support was fixed at $399.61 as of June 2001. This figure, while suspiciously close to sawing off the difference between the motions judge and the Divisional Court, was arrived at only after truly extensive analysis. In many respects, that analysis was quite convincing.

“SOMETHING NICE” ABOUT THE COURT OF APPEAL’S DECISION

The appellate court’s thorough analysis of section 9 makes a number of very logical, sensible and eminently legally defensible points:

- There are five distinct areas in the Guidelines where the court may deviate from the standard table amount:

- subsection 3(2) — child over age of majority;

- section 4 – payor’s income over $150,000;

- section 5 – payor spouse stands in place of parent;

- section 9 – shared custody;

- section 10 – undue hardship.[6]

- The Divisional Court was simply wrong in adopting a consistent approach “to all of these discretionary exceptions to the Guidelines”.[7] Different language is used in these sections. The appellate court instructed us to just read the language and apply the plain language that the Guidelines employ.

- Under section 9, there is no “presumption” in favour of the table amount.[8]

- The payor has no onus to establish that departure from the table amount is warranted.[9]

- “In considering the interpretation of s. 9, the goals of predictability, consistency and efficiency must similarly be balanced with those of fairness, flexibility and recognition of the actual ‘condition, means, needs and other circumstances of each spouse and of any child for whom support is sought’ (s. 9(c)). A court must also consider the amounts set out in the tables ‘for each of the spouses’ (s. 9(a)); and ‘the increased costs of shared custody arrangements’ (s. 9(b))” [emphasis added][10]

- The approach under section 9 is markedly different from the approach under sections 3 and 4.[11]

- The motion judge likewise erred by treating this section 9 case essentially as a section 8 matter. Section 8 (split custody situation that mandates a straight set off of the table amounts) “does not grant any discretion to the court.” Section 9 requires “an individualized, fact-specific approach to each case.”[12]

A FORMULA APPROACH

The Court then discussed the utility and appropriateness of applying a “formula” to the amount obtained through an application of the straight set-off approach under paragraph 9(a). The Court stated:[13]

…courts across the country have struggled to develop an interpretation

of s. 9 of the Guidelines that promotes the Guideline objectives of ensuring consistent treatment of spouses and children and reducing conflict

by making calculation of child support orders more objective. To that end,

most courts have utilized various formulae as a means of bringing some

objectivity and consistency to the exercise.

The Court of Appeal indicated that formulae are desirable but not necessarily so, depending on whether the recipient parent has sufficient funds to meet a child’s needs.[14] It is at this point in the analysis that your writer starts to part company with the Court of Appeal. I would ask: why in a situation where both parents essentially enjoy custody of the child should we focus only on the recipient parent’s financial resources? Since both parents are deemed to have custody, might not this blindness to the payor’s resources prejudice the child’s financial security in that household?

The next paragraph of the decision returned to a proper, fact-sensitive and child-centred approach by emphasizing that we must analyze the facts of the individual case with regard to the child’s material needs in order to come up with a support amount that is fair to the child across both households in which the child resides [my own emphasis added]:[15]

The amount produced by a formula that takes into account the Table amounts of both parents as required by s. 9(a) must then be modified to take into account the factors set out in ss. 9(b) and (c). As Eberhard J. stated at para. 5 in Rosati v. Dellapenta , supra, cited with approval by Prowse J.A., in Green, supra, at para. 24, “Time tells me little about who arranges for the children’s material needs.” In order to ensure that the best interests of the children prevail, the section needs to be read as a whole and effect must be given to each of the subsections of s. 9. The objectivity of a formulaic approach is of little value if the best interests of the child in receiving adequate support are not met.

I assume (admittedly perhaps incorrectly) that when the Court talks of the “child … receiving adequate support”, I take that to mean that the child should receive adequate support in both households. My interpretation might be a bit of a stretch although I do believe that, from a policy perspective, it should be correct.

I suggest that the Court’s approach in viewing section 9 parents as “custodial” or “access” type of parents was not necessarily in accordance with section 9. The court stated [my own emphasis added]:[16]

… we are aware that any formula that has the effect of dramatically reducing support can create financial incentives on the part of a custodial parent to limit access, and on the part of the access parent to seek increased time with the child or children solely to reduce the quantum of the child support obligation. The application of any formula should strive to minimize these incentives, which go directly against the best interests of the child and in effect create a phenomenon of trading “dollars for days”.

In Contino, we had a parent who was formerly exercising access. The court’s concern for trading “dollars for days” was sensitive and well placed. However, this approach has little utility in the case of those parents who start from a 50-50 shared time arrangement. Neither is the Court’s admonition particularly apt for those parents who truly split most of the child’s expenses either equally or in accordance with the parents’ respective incomes. Treating such parents as essentially “access” parents and then ordering the so-called “access” parent to pay child support to the so called “custodial” parent could very well work an injustice towards the child who is prejudiced financially in one household and possibly unnecessarily benefited in the other household.

WHAT SHOULD REALLY MATTER?

Although the Court of Appeal hinted at the correct approach when it apparently adopted the admonition that time alone does not tell the story as to which parent(s) arrange for the child’s material needs (discussed above), I suggest that, further into its reasons, the court appeared to have lost that focus. Section 9 envisages two situations:

- A spouse might be merely exercising a “right of access” consisting of 40% or more of the child’s time. This could imply a parent who simply visits with a child and does not assume an extensive day-to-day financial responsibility for the child.

- A spouse might have “physical custody of a child” consisting of 40% or more of the child’s time. This could imply a spouse who does indeed assume substantial financial responsibility for the child.

I ask: Under section 9, what should really matter for the purpose of fixing a fair amount of child support? It should not be the mere time spent with each parent but rather the characterization of the arrangement as reflected in who incurs what costs for the child’s benefit. As stated above: “Time tells me little about who arranges for the children’s material needs.” I therefore suggest that a proper interpretation of section 9 requires that the following questions, amongst others depending upon the facts, be addressed:

- Who pays for the child’s clothing?

- Who pays for the child’s activities?

- Do both parents pay the same amounts?

- Does each parent incur child-centred costs in accordance with his/her financial ability?

- Does one parent incur the bulk of the financial responsibilities?

- Do both parents incur similar or disparate housing costs for the child?

- What tax benefits are available to each parent?

- Would transferring funds from one household to another positively, adversely or neutrally affect the child’s well being in each household?

I submit that these are the type of questions under paragraphs 9(b) and (c) that need to be asked and answered.

INCREASED COSTS OF SHARED CUSTODY

Paragraph 9(b) stipulates that one of the factors to consider is “the increased costs of shared custody arrangements”. The paragraph itself apparently does not answer one fundamental question: What is the proper baseline from which to measure those “increased costs”?

Should we start from the payor’s existing child-centred expenses (as stipulated by the Court of Appeal)? Or, should there be another baseline from which those “increased costs” ought to have been measured? If there was some other baseline, do the Guidelines give us any hint as to what that baseline should be?

The Court of Appeal appeared to make a general assumption that section 9 only addresses a situation where the former “access” parent moves from less than 40% of the time to more than 40%. This is understandable as this was the underlying fact configuration in Contino. Yet this case will likely be used as a precedent where the factual underpinnings could be quite different. A simple application of a precedent that might be more applicable to one of set of facts could cause an injustice when applied to a qualitatively different fact situation.

One can easily conceive of different factual configurations where we may not be addressing a situation of moving from less to more than 40%. Rather, we may be addressing a situation with 50-50 shared time or something close to it from the outset. We may be starting from a situation where the parents are already equitably sharing the expenses related to the child. Under section 9, do courts actually take cognisance of who actually incurs child-centered expenses that do not come under section 7 of the Guidelines?

The difficulty that courts may have in approaching section 9 might be related to a gender-centered analysis versus a reality-centered analysis. Most support payors are men. There is a natural ingrained tendency to require the man to continue to pay the woman since this is usually what happens. The implication of this approach is that our baseline is the proposition that the court must analyze how much the payor parent (whom we describe as the “access” parent) must now pay to the continuing support recipient parent (whom we describe as the “custodial” parent). Therefore, what the Court was doing here was assuming the obligation to pay child support whereas I would argue that section 9 actually contains no such assumption or presumption. I would argue that the customary approach tends to unfairly discriminate against support payors in section 9 cases. I would further argue, with respect, that the approach of the Court of Appeal in Contino tends to reinforce these gender-centered assumptions, although this might be as a result of the specific facts in Contino.

The Court examined the issue of the increased costs of the applicant parent.[17] The Court discussed the “additional costs” that the applicant parent might have. The Court stated [18] “that the applicant parent must show what his or her costs are for time spent with the child in excess of 40 per cent.” The Court went on to state that, if this applicant parent were already providing a bedroom for the child, then the fact that this parent went over 40% would not constitute incurring an increased cost.

The Court, in reading paragraph 9(b), assumed that we must look at the “access” parent’s increased cost for the child as a result of passing the 40% threshold. Applying this approach generally, we might ask what costs over and above his previous child-centred costs is this father now assuming. Certainly, one can well appreciate that moving from 39% of the child’s time to 41% of the child’s time is unlikely to result in any real change in the “access” parent’s child-centred costs. The implication then, at least when applying paragraph 9(b), is that there are no increased costs for the “access” parent and therefore, he or she will not succeed in achieving any reduction from the table amount on the basis of paragraph 9(b), at least upon the basis of proving increased access costs.

THE HIDDEN TRUTH UNDERLYING THE DESIGN OF THE STANDARD TABLE AMOUNTS

We are struggling with the issue of the proper baseline from which to measure the increased costs of shared custody. Perhaps we can find an answer concealed within the original design of the Guidelines themselves. No case has yet discussed or recognized the true philosophical basis upon which the standard table amounts were calculated in the first place. I maintain that the courts, including the Court of Appeal, have therefore failed to appreciate how the standard table amounts were really constructed in the first place. There is a philosophy underlying the standard table amounts. Court decisions should be in accordance with the philosophical underpinnings so as not to cause a distortion to the expressed goal of fairness expressed in the preamble to the Guidelines.[19]

In truth, the Federal Child Support Guidelines (and by consequence, the provincial counterparts) assume, in the actual design of the numerical entries for the table amounts, that the access parent incurs absolutely no costs for the child. (This has enormous ramifications with respect to the manner in which section 9 should be interpreted.) On the surface, one might think that the author’s bald statement must surely be false because most people would readily recognize that even occasional child access comes with a direct financial cost. That may be a reasonable assumption but it is not one that was used when the Guideline table amounts were constructed.

To prove the point that the Guidelines do indeed assume that the payor parent has absolutely no costs associated with the children, one need search no further than an overlooked publication authored by the Child Support Team from the Department of Justice Canada, Formula For the Table of Amounts Contained in the Federal Child Support Guidelines: A Technical Report (CSR- 1997-1E) (Child Support Team, December 1997):[20] Indeed, the philosophical and theoretical underpinning of the entire standard table amount is premised upon the fact that the payor parent incurs absolutely no child-centred costs. This Justice Canada paper seeks to explain how the department came up with the table amounts. What were the assumptions used? What went into devising the mathematical formula? What were the Guidelines trying to achieve?

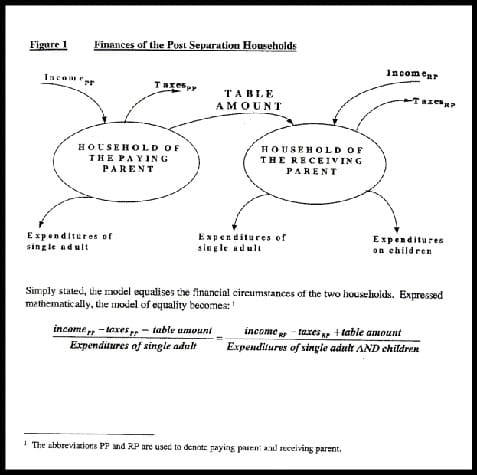

Below is Figure 1. It is reproduced directly from the Justice Canada report.

[If you cannot see Figure 1 on your browser, try: https://canada.justice.gc.ca/en/ps/sup/pub/reports/csr-1997-1.pdf. ]

The household of the paying parent is assumed to have expenditures only for a single adult. The household of the receiving parent is assumed to have expenditures for a single adult plus expenditures for the children. The standard table amount is constructed according to a corresponding mathematical formula that incorporates these assumptions. Look at the denominator on the right hand side of the equation. Only on that side does the formula include expenditures for the children. The clear (and patently false) assumption is this: the paying parent does not incur any such expenditures.

The model depicted in Figure 1 holds true whether there are one or more children in the recipient’s household. Other assumptions are set out in the report. No matter what the exact fact configuration, the model founds the underpinning of the table amounts. The report states: “These technical assumptions have the narrow purpose of producing the mathematical model. They do not restrict the application of the tables to real life situations which may involve more complex family arrangements.” [21]

The model is adapted somewhat to provide for self-support by the support payor. This is specifically noted in the report: [22]

It is recognized that all persons have basic needs that must be met. If the

formula does not take this into account, persons could begin paying child

support on the first dollar earned. Therefore, the first modification to the

formula incorporates an amount required to allow for the self-support of

the paying parent. This basic need amount, termed “self-support reserve”,

is an amount deemed to be required for a minimal standard of living for a

single adult. It is used as the starting point for child support responsibility.

There are only two other modifications to the model:

- modification at low income levels; and

- modification to smooth the curve.

There is no modification to allow the payor parent to pay even one cent for the housing, food, or any other expense for any child with him up to 39% of the child’s time. It is only when the time reaches 40 per cent that the law allows for any leeway. This report does not discuss the 40 per cent issue as it is not relevant to the philosophical underpinning of the table amount.

The design assumes that only the custodial parent incurs costs for the child. The policy implication of this basic design must therefore be that a parent who newly comes under the purview of section 9 moves from zero costs to all of the costs that the Guidelines assume for a support recipient. It must follow that all of those costs must be the “increased costs of the shared custody arrangements” because the Guidelines in their basic design assumed that the access parent formerly had absolutely no costs at all for the child.

The Court of Appeal established a very clear section 9 baseline: the court must have assumed that the table amount had implicitly allowed the payor some child-centred costs as a starting point or baseline because the court would agree to examine only the payor’s costs over and above his previously established child-centred costs. There could be no other reason for starting at x dollars (equal to existing costs to exercise access) as opposed to zero dollars (equal to costs as assumed under the Guidelines when a parent exercises access).

Further support for this glaring disparity between the actual design and underlying rationale for the standard table amount versus subsequent judicial interpretation can be found in the academic literature.[23]

The implications of this model need to be digested slowly to appreciate their magnitude. The following chain of reasoning may prove instructive.

- The first step is an easy one but it is breathtakingly blunt. It deals with ordinary cases – those cases where access is exercised less than 40 per cent of the time, quite outside the scope of section 9. The stark reality is that, in those ordinary cases, the arithmetic entries that are set out in the tables are ab initio biased against the access parent (regardless of gender). The courts that routinely invoke the tables are (unwittingly, to be sure) using numbers crafted by Justice Canada that are admittedly blind the simple economic reality that access visits (or residential time even under 40 per cent of the child’s time) come with a price tag that the access parent must assume. It amounts to a hidden expense for which he or she is given no credit by the court and for which he or she probably cannot obtain relief by other means (such as through income tax adjustments). From the economic perspective, the payor with access is being treated no differently than a payor who has no access at all.

- Having absorbed the impact of the first step, one can move to a consideration of the scenario envisaged in section 9 of the Guidelines as interpreted by the Court of Appeal. As indicated already, the decision in Contino restricts the payor to claiming only those incremental expenses that result from the shift in access time from less than 40 per cent to more than 40 per cent. From the court’s perspective, this seemed objectively fair because the court likely operated upon the honest assumption that the table amounts gave the payor credit for the expenses that he bore when access time was less than 40 per cent.

- In light of the Justice Canada report, however, that assumption is stunningly false. The naked truth (as pointed out in step 1) is that the table amounts give the access parent no credit for the expenditures incurred in exercising access less than 40 per cent. If one then applies the principle of incremental allowance preached by the Court of Appeal to this naked truth, the access parent is arguably subjected to an elevated level of economic bias. A court may sincerely believe that it is being fair and balanced in recognizing only an incremental increase in the payor’s access expenses but, at the arithmetic level, the payor is really being awarded a mere pittance to adjust from a regime where he or she was treated as if he or she had no access at all to a regime that, in many cases, should involve a 50-50 sharing of expenses.

Although surely unintended by any of the judges on the Court of Appeal, this, perhaps, is the greatest shortcoming of the decision in Contino – a shortcoming that, for the children involved, must inevitably create an adverse effect on household environment of one of the parties. Regrettably, any corrective measure may have to await another appeal to the Court of Appeal or a ruling by the Supreme Court of Canada either in this case or on appeal from some other decision.

FIXED COSTS

The Court expressed justifiable concern for the former sole custodial parent’s fixed costs not changing appreciably.[24] In the same paragraph, the Court expressed a child-centred approach when it stated: “the child should, so far as possible, enjoy a comparable standard of living in both households.”[25] But the thrust of the Court’s approach exhibited some degree of favouritism for the concerns of the former sole custodial parent in preference to the other parent. A court should be, I submit, equally solicitous of the other parent’s fixed costs as well. Should not those fixed costs be given equal weight at law under section 9? If the time is split 50-50, are not both parents equally custodial parents now? Does it really make that much difference if the time is 40 per cent or 50 per cent? It could be argued that the court is discriminating against an identifiable class of individuals here. Section 9 itself does not discriminate. The goal of trying to achieve a comparable standard of living for the child in both households does not in itself necessarily discriminate.[26] On the other hand, emphasizing only one parent’s fixed costs may indeed discriminate where a plain reading of section 9 itself simply does not afford any such advantage to one parent over the other.

VARIABLE COSTS

When discussing paragraph 9(c), the Court correctly told us to look at spending patterns.[27] I agree that it is important to determine who is spending what on the child. Addressing this question gives paragraph 9(c) its vibrancy and ability to cope with individual fact situations in a fair manner. For example, I would submit that if one parent is purchasing all of the child’s clothes, then the child support order should be adjusted to compensate that parent. But if both are buying clothes in accordance with each of their financial abilities, then there should be no fine adjustments.

Evidence is important. Again, in this area the Court showed a greater solicitude for the “responding parent” than the applying parent. The Court correctly cautioned the responding parent (that is, the assumed support recipient) to present a child care budget if that parent wished to contend the child’s expenses exceed the table amount. If that is so, then the Court told us: “In such situations, it may be that the overall support required to meet the needs of the child will exceed the Table amount of one parent.”[28] One could conceive of a situation where the applying parent might likewise have child-centred expenses in excess of the table amount as well. Why should the focus only be on the needs of the child within one household? Is only one household worthy of the Court’s concern? Emphasizing only one parent’s child expense budget to allow for needs above the table amount to the exclusion of mentioning the other parent’s budget may indeed discriminate.

The Court’s analysis of the increased cost issue is unfair in the result in that the decision and the Guidelines themselves ignore the fact that even regular non-custodial parents incur significant costs for the care of their children. The fact of such expenditures has been documented. One Australian study[29] concluded that costs of contact are high. For contact with one child for a mere 20 per cent of the year, costs of contact were found to represent about 40 per cent of the costs of that same child in an intact couple household with a medium income and more than half of the costs of that child in a household with low income. The authors found that household infrastructure and transportation were principal reasons for the high costs although other aspects of the non-custodial parent’s costs were also examined. The cost for lower income households was proportionally significantly higher than higher income households, indicating the hardship that is visited upon many low-income noncustodial parents. One implication of this finding is that the total cost of children substantially increases when parents separate. One of the policy implications of the authors’ finding, they described as follows:

With regard to child support policy, there appears to be a need for many child support schemes to recognize better that non-resident parents can face significant financial costs from providing relatively small amounts of contact.[30]

The effect on the non-residential parent’s children can be very significant. The authors noted that the structures inherent in child support legislation, “may place a level of financial burden on some non-residential parents that restricts their capacity to have adequate contact-care of their children.”[31]

I would therefore argue that by focussing on what is essentially a practical impossibility for the previous non-residential or non-custodial parent to prove his increased costs simply upon reaching the 40 per cent threshold (as opposed to recognizing that parent’s fixed and discretionary costs of exercising access or joint custody), both the Court and the Guidelines themselves are unfortunately perpetuating what may very well be a most unjust treatment of children in one parent’s household.

THE MULTIPLIER

In order to actually apply section 9 in practice, the Court started with paragraph 9(a) — we consider the table amount that each would have to pay to the other. That is the simple set-off approach. The Court then turned to the issue of the appropriate “multiplier” to use in order “to reflect the mother’s fixed costs.”[32] Again, the emphasis was immediately (and I would argue, inappropriately) placed on the support recipient’s (mother’s) fixed costs as if the father’s similar fixed costs did not matter at all. Again, why did the Court fail to even consider the father’s fixed costs as well? Were his fixed costs any less important or worthy of consideration? Do we start with the mother simply because she is the “mother”? If it is “gender” that is at play here, then the approach is discriminatory. Somewhat magically, in this case the Court came up with a multiplier of 67.6 per cent. The multiplier was applied to the figure obtained by deducting mother’s table amount from father’s table amount. In Contino, the difference was $128. The application of a multiplier of 67.6 per cent to that difference of $128.00 yielded a preliminary figure of $215. By grossing up on account of only the mother’s fixed costs (and not the father’s), the Court has discriminated against the father. His fixed costs were apparently not worthy of consideration even though he surely must have incurred such costs.

VARIABLE EXPENSES DIFFERENTIAL

The Court then turned to apply paragraph 9(c). The approach it took was to examine the parents’ actual spending patterns for the child. On the facts, the Court concluded that the mother’s variable expenses were $403.41 while the father’s were $270 per month. The Court concluded: “The total variable expenses should be shared by the parties in proportion to their incomes.”[33] Therefore, the Court added the total variable expenses of each parent to obtain an arithmetical total of $673.41. It then applied the ratios of the parents’ incomes to that figure of $673.41. The father earned 55% and the mother earned 45%. The father was therefore responsible for 55 per cent of $673.41, or $370. Since he was already paying $270 within his own household, the Court obligated him to assume responsibility for the difference between $270 and $370 which equalled $100. The Court then added this $100 to the $215 amount that we explained above, and the total of $315 per month now replaced the table amount of $688.[34]

Section 9 does not mandate an equal sharing of the parties’ variable child-centred expenses. In contrast, the Guidelines do mandate the sharing of special and extraordinary expenses under section 7 in proportion to the parties’ respective incomes. The expressed objectives of the Guidelines as noted in section 1 and in the Divorce Act in subsection 26.1(2) do not mandate the sharing of variable expenses as decided by the Court of Appeal. Paragraph 9(b) mandates a consideration of “the increased costs of shared custody arrangements”. Paragraph 9(c) mandates a wide and elastic consideration of the parents’ and child’s circumstances. Perhaps the Court of Appeal has read into section 9 an approach that might not have been intended.

DISCRIMINATION?

Each party’s income was already considered when the Court determined that the first part of the father’s obligation as a result of set off was $128.00. Grossing up that figure by any amount to compensate the other parent on account of fixed costs without considering the payor’s fixed costs must surely result in unfairly degrading the child’s standard of living in the payor’s household. It would appear that at each stage of the process we are grossing up what the father has to pay. Keep in mind as well our earlier discussion with respect to the basic design of the Guidelines: the design assumes against all common sense and logic that the “access” parent has absolutely no child-centred expenses. The net effect of the approach by the Court of Appeal in implementing section 9 coupled with the manner in which the table amounts were first constructed is that, across the board, we are largely negating the payor’s existing fixed child-centred expenses. The default position seems to be to give priority to the former sole support recipient and to the recipient’s fixed expenses. This would appear to constitute discrimination against the former support payor who moves into a 40 per cent of time bracket. If the Court of Appeal’s analysis is applied to those who share time more or less equally from the outset, then similarly one side is likely to experience discrimination when the approach advocated by the Court of Appeal in Contino is applied elsewhere.

TAX IMPLICATIONS

The Court of Appeal has not considered the tax implications of a shared custody arrangement even though paragraph 9(c) would allow for this. By failing to do so, one could argue that the parent who is unable to claim certain credits has suffered unjustifiable discrimination. This results in unfair treatment of the child when he is living with that parent. The CCRA will not permit a parent who pays any child support during any part of the year to claim the “eligible dependant credit” (equivalent-to-spouse credit). With respect to the Child Tax Benefit, if the parties cannot agree on which parent should receive it, the CCRA will determine who in its view has primary responsibility for the child and make the payments to that person.[35] These two tax factors can have a significant effect in a section 9 situation and they ought to be considered.

EVIDENCE

At paragraph 80 of its reasons, the Court noted that the motions judge could have adjourned to require the parties to lead further evidence. This showed a commendable sensitivity to the importance of getting the relevant information before the Court in admissible fashion.[36] However, at paragraph 101, the Court admitted that it did not have financial information for the years 2002 and 2003. I would suggest that, in order to place that information before a court, the case ought to have been referred back to the motions judge to receive that evidence and decide the issues for 2002 and 2003 in accordance with that properly introduced evidence and the decision of the appellate court. What was the Court possibly thinking then when it invited counsel to “serve and file brief written submissions within 30 days”? “Submissions” do not constitute evidence. The Court’s approach with respect to new evidence is puzzling and contradicts the Court’s own recently expressed views with respect to the importance of affording procedural fairness to the litigants.[37]

CONCLUSIONS

The Court of Appeal correctly admonished both the motions judge and the Divisional Court. The Court justifiably distinguished between section 9 cases and others and directed our attention to the fact that we must apply all of section 9 including its three paragraphs. However, after having interpreted section 9 in a general way that made sense, the Court of Appeal in implementing its general propositions unfortunately demonstrated a greater concern for the parent in the position of responding to a section 9-based application. This could possibly derive from employing a conventional approach with respect to usual gender roles and it could partly be blamed on the failure of the court to appreciate the basic design behind the construction of the standard table amounts. Unfortunately, the approach of the Court of Appeal in its implementation of section 9 may serve to compromise the child’s standard of living in one household and this approach might constitute impermissible discrimination against the parent of that household. This writer has argued that the Guidelines should require us to be diligent to fully employ the elasticity of paragraph 9(c) to deliver equity and fairness to families who share residential time on a substantially equal basis. Most importantly, section 9 should be interpreted in a manner so that both parents are afforded equal rights and responsibilities.

* Gene C. Colman practises family law in Toronto, Ontario. The article is adapted from and was previously published in (2004), 22 Canadian Family Law Quarterly 63, by permission of Carswell, a division of Thomson Canada Limited. The author gratefully acknowledges the editorial assistance of Mr. Roman Komar, Research Counsel at the Judicial Research Centre – Office of the Chief Justice, Ontario Court of Justice. The author gratefully acknowledges the helpful comments offered by Mr. Paul Millar, University of Calgary doctoral candidate in sociology and by Mr. Brian Jenkins FCIA, President of ActuBen Consulting Inc. The author assumes sole responsibility for the contents of this paper.

FOOTNOTES

[1] SOR/97-175. In Ontario, see the Child Support Guidelines, O. Reg. 391/97.[2] “The real problem in Contino v. Leonelli-Contino, as in other cases under s. 9 of the Guidelines, was that the courts have not adopted a consistent analysis to decide child support in shared-custody cases.” From Annotation by Prof. James G. McLeod accompanying the Divisional Court report of this case.

[3] James G. McLeod: This Week in Family Law, Fam.L. Nws. 2003-45 (Family Law Source, Westlawecarswell , November 11, 2003).

[4]Contino v. Leonelli-Contino (2002), 2002 Carswell Ont. 4092, 30 R.F.L. (5th) 266, 62 O.R. (3d) 295, 166 O.A.C. 172 (Ont. Div. Ct), varied (2003), 2003 CarswellOnt 4099, 42 R.F.L. (5th) 295, 178 O.A.C. 281, 126 A.C.W.S. (3d) 298, [2003] O.J. No. 4128 (Ont. C.A.) [hereinafter cited to C.A.].

[5] Francis v. Baker, [1999] 3 S.C.R. 250, 177 D.L.R. (4th) 1, 246 N.R. 45, 50 R.F.L. (4th) 228, 125 O.A.C. 201, 1999 CarswellOnt 2734, 1999 CarswellOnt 2948, [1999] S.C.J. No. 52 (S.C.C.).

[6] Contino v. Leonelli-Contino, supra, note 4 at para 31.

[7] Ibid. at para. 32 – 40.

[8] Ibid. at para. 35.

[9] Ibid. at para. 35.

[10] Ibid. at para 39.

[11] Ibid. at para. 40.

[12] Ibid. at para. 44, 45 and 52.

[13] Ibid. at para. 50.

[14] Ibid. at para. 54.

[15] Ibid. at para 55.

[16] Ibid. at para 57. Cf. Paragraph 70: “…the subsection recognizes that greater access is not reflected in a dollar for dollar decrease in the spending of the custodial parent.” [Author’s emphasis]

[17] See paras. 75 et seq. and para. 87, supra, note 4.

[18] Supra, note 4 at para. 76.

[19] Section 1: “The objectives of these Guidelines are

(a) to establish a fair standard of support for children that ensures that they continue to benefit from the financial means of both spouses after separation; …”

[20] Department of Justice Canada, Formula For the Table of Amounts Contained in the Federal Child Support Guidelines: A Technical Report (CSR- 1997-1E) (Child Support Team, December 1997). This obscure eight page publication is a must read. After not being publicly posted for many years, it is now available on the Department of Justice website at https://canada.justice.gc.ca/en/ps/sup/pub/reports/csr-1997-1.pdf.

[21] ibid., p. 2.

[22] ibid., p. 5.

[23] Paul Millar and Anne H. Gauthier, “What Were They Thinking? The Development of Child Support Guidelines in Canada” (2002) 17(1) Canadian Journal of Law and Society 139, especially at p. 155: “…the legislated guidelines do not account for child-related costs for the non-custodial parent.”

[24] Supra, note 4 at para 77.

[25] Note that the design of the Guidelines, as per Figure 1, assumes a policy goal that more properly belongs to Parliament than to a working group within Justice Canada: “… the model equalises the financial circumstances of the two households.” Neither the Divorce Act nor the guidelines mandate any such approach. Parliament has spoken in s.26.1(2):

The guidelines shall be based on the principle that spouses have a joint financial obligation to maintain the children of the marriage in accordance with their relative abilities to contribute to the performance of that obligation.

The Guidelines objectives are set out in section 1:

- The objectives of these Guidelines are:

- to establish a fair standard of support for children that ensures that they continue to benefit from the financial means of both spouses after separation;

- to reduce conflict and tension between spouses by making the calculation of child support orders more objective;

- to improve the efficiency of the legal process by giving courts and spouses guidance in setting the levels of child support orders and encouraging settlement; and

- to ensure consistent treatment of spouses and children who are in similar circumstances.

The legislature has not mandated the equalizing household incomes or household standards of living. Such a goal would, of necessity, import an element of spousal support into the Guidelines. Surely, this should require public and parliamentary debate.

At page 2 of the Justice Canada report, the authors state: “Simply stated the model equalises the financial circumstances of the two households”.

At page 4, they state: “As stated earlier, the objective is to determine the amount that must be transferred from one household to the other in order to make them ‘equally well off’, that is, the child support table amount.” These views stands in sharp contradistinction to the Supreme Court of Canada’s understanding in Francis v. Baker, supra, note 5 at paragraph 41:

However, even though the Guidelines have their own stated objectives, they have not displaced the Divorce Act, which clearly dictates that maintenance of the children, rather than household equalization or spousal support, is the objective of child support payments.

[26] There may not be discrimination in trying to achieve this goal but as a goal, it might be beyond what the Guidelines actually mandate. See the above footnote.

[27]Supra, note 4 at para. 78.

[28] Ibid. at para 83.

[29] Kyle Mitchell & Paul Henman, “Estimating the Costs of Contact for Non-resident Parents: a budget standards approach” (2001) 30 Journal of Social Policy 495.

[30] Ibid.

[31] Ibid.

[32] Supra, note 4 at para. 90.

[33] Ibid. at para. 93.

[34] On the facts, the RESP to which the mother contributed was found to be a section 7 special expense; therefore, the court required the father to pay 55 per cent of the RESP amount of $153.84, or $84.61 monthly. Add that latter amount to the $315 and presto, the final amount was $399.61 per month.

[35]See: Andrew Freedman et al., Financial Principles of Family Law (Toronto: Carswell, 2001) at s. 39.2(v).

[36] With respect to the importance of a trial judge ensuring that the process for the introduction of evidence and the consequent challenging of that evidence is in a proper forum, see: Farrar v. Farrar (2003), 63 O.R. (3d) 141, 167 O.A.C. 313, 222 D.L.R. (4th) 19, 32 R.F.L. (5th) 35, 2003 CarswellOnt 195, [2003] O.J. No. 181 (Ont. C.A.).

[37] Id.